What exactly is this employee ownership thing, then?

Simply speaking, EO is a form of exit strategy for a founder who wants to extract value from their business before finally leaving to retire or to do other projects.

The usual way to achieve this is a commercial sale to another owner, but this way you can lose much that makes the business unique – its values, skills base, culture, and community. There’s no guarantee a future owner will preserve any of these for very long, if at all.

And not every business owner is driven only by extracting the most possible cash out of the sale.

What might drive an EO sale, other than the money?

The alternative option, of selling the business to its own employees, may be a way of:

- leaving something of value to loyal and long-standing colleagues, These are often people who wouldn’t have access to an opportunity like this any other way. It’s a valuable legacy and the ultimate vote of confidence.

- preserving the business as an independent entity, with its culture, reputation and working community intact – a vitally important driver for many owners.

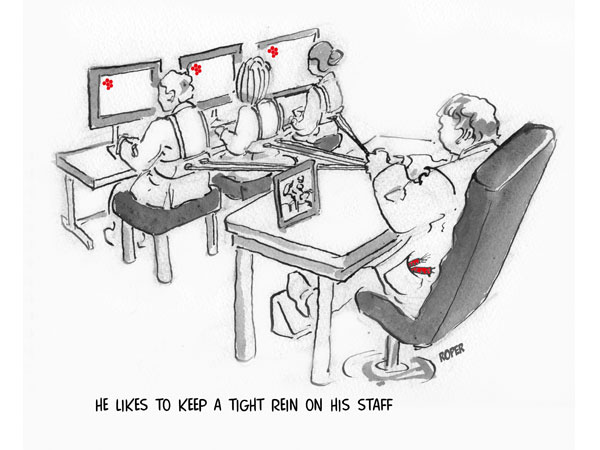

- enjoying a new and less burdensome kind of business leadership. Not every business owner wants the handover of their business to be their final contact with it – they are not ready to ‘exit’. Through EO, you can choose to remain with the business but shift the responsibility of decision-making by passing it to trusted colleagues.

So the business simply continues as it has been, but under new ownership?

Well, yes and no. EO companies we have worked with do indeed find in the early stages that not much seems to have changed. Everybody is still there, sometimes even including the soon-to-exit founder/owner. And if the company has been well run in the past, and maybe always shared some of its profits with the employees, then this continues in much the same way, though the profit share now benefits from being tax free.

But slowly a shift starts to happen. Guided by the new leadership team and the trustees of the EO Trust or an Advisory Board, employees start to realise that they really do have a stake in the company’s future. Appropriately encouraged, they show an interest in how the company works and find out the drivers of its success. Now they have skin in the game, they start to care more, bring fresh ideas, take initiative, and work harder. Studies show that employee-owned companies see an average of a 4-5% boost in productivity.

And the change is palpable – attending the conference of the EO Association a few years ago, I was immediately struck by the energy, enthusiasm and general buzz that gave it an atmosphere totally unlike any other business conference I had ever been to. From lovely northern ladies running a knitwear factory in Lancashire to a small architects’ practice employing a handful of people, EO galvanises people, rekindles their enthusiasm and gives them a sense of having a stake in their own future.

So what are the benefits?

EO isn’t just a feel-good strategy – it’s a competitive advantage. EO may not necessarily remunerate you as a business owner quite as lavishly as a successful commercial sale, and you may have to wait a few years for all the money to come in. But you’ll have the satisfaction of knowing that your cherished creation is in excellent hands, guided by people you trust to preserve your legacy.

Your former employees will enjoy not just tax-free benefits but job security in a setup that they can contribute to and have a say in. New employees will be drawn to the business because it’s not just about the bottom line – it’s about shared success. There’s something deeply attractive about a company that empowers its people.

It doesn’t just happen

Take care not to fall into the trap of assuming that EO will automatically ensure engaged employees and continuing business success. If you only complete the legal and financial transaction and walk away, there’s strong possibility that the new leadership of co-owners will at some stage just fall flat on their faces. It’s crucial to take the following steps:

- Spend some time before the transition to identify and capture what makes the business work – from systems and processes to cultural practices and behaviours. Start this work a good 2-3 years before the anticipated date of EO.

- Identify future leaders and start to include them in the work of creating strategy, making plans and managing teams. If you start early enough, you will have time to coach and test them before handing over your business to them.

- Start the challenging process of ‘letting go’ – this is one of the hardest things you will have to do, and it’s best to give yourself time.

- Clarify the role of MD for the future. Whatever it looks like, it won’t look like what you have done for the last however many years. Get skilled outside help to do this – and do it with the future leadership team, so they can have their say and an input into how it looks.

- Create an Advisory Board (maybe the Trustees if you decide to create an EO Trust) to support the new leadership team through the next few years of taking the helm. You should not necessarily feel you have to be part of this Board!

A Future-Proof Business Model

If you get it right, EO is a business structure that ensures continuity and stability whatever the market does. When employees are shareholders, they have a vested interest in keeping the company strong – it gives the business a built-in layer of resilience.

A carefully designed, gradual handover will give the best chance of future success, and the shift in ownership opens doors to fresh ideas, increased productivity, and long-term growth.

And it’s not just your former employees who now have a stake in the future – by passing on your business in this way, you do too. It’s something to be immensely proud of.

If you’d like to discuss any of the issues in this article, email me at km@leaderslab.co.uk or call 07801 259637.